3rd August 2021

Trends in the recovering economy – Food & Beverage Consumption in the Wake of the Recession.

Introduction

“I think that if we’re able to get the public health under control that normality will return more quickly than it does after financial crises or normal recessions, but I’m not sure of that”, told US Treasury Secretary in April 2020 when he explained the importance that the role of an effective vaccine roll-out would make in helping the US economy recover from the Covid-19 recession.

There is a gap between the economic health of countries that rolled out an effective vaccine program and those that have not. It is important for producers to understand what consumer habits will prevail and where. The primary effect of ineffective addressing of Covid-19 is a lack of consumer confidence which leads to economic contraction and consumers fall into recessionary shopping habits. Some of these countries include India, China, and Russia, and FMCG Gurus research shows only 50 percent of global consumers are confident about the economy of the country they live in (February 2021).

For these countries, recessionary consumer habits can be expected of which this piece will explore. On the other side, countries with effective vaccine programs will see consumers follow through with trends that could be seen previously. As of July 2021 in the UK, the state of the economy is outlined by a recovering unemployment rate and pre-pandemic levels of consumer confidence. According to the ONS, the unemployment rate, was 0.9 percent higher than pre-pandemic levels at 4.8 percent however 0.2 percentage points lower than the previous quarter (December 2020 to February 2021).

This trend may not continue due to the worsening fears of the delta and gamma variants of Covid-19. FMCG Gurus research has found that 58 percent of global consumers have said that they are worried about the third wave of Covid, 19 percent of global consumers believe that there will be a major impact on everyday life due to Covid (February 2021). Emerging from the pandemic, consumers will behave in similar ways to what would be expected irrespective of the pandemic such as high environmental awareness, increased consumption of food considered for its health benefits, and greater consideration for moral food and beverage producers.

Environmental Consciousness

Moving past Covid-19, more consumers have declared that they plan to take more action to help the environment. These products are likely to command a premium price and so will likely continue to trend in countries recovering from Covid successfully. As a premium, the cost of environmental responsibility is one that consumers are willing to pay as this is a consideration of higher priority. This trend will be stunted in countries severely affected by Covid-19 due to the poor state of the economy leading to the population possessing less disposable income on average. Hi/low consumerism will play some factor however there still will be an effect.

There is a consistent and notable separation in regions that are receptive to environmental responsibility. Where there are environmental hazards that have high media coverage, (South America and deforestation, Asia-Pacific with air pollution and the great barrier reef) these regions are more considerate about the environment likely due to an abundance of information and an emotional affinity to helping resolve these issues.

Within these regions, India, a significant market, has had a rocky vaccination roll-out and so the economic effects of the recession are likely to be particularly harsh. This indicates that consumers are likely to want cheaper products that are more considerate of the environment such as increased consumption of natural products like fruit and vegetables rather than the more expensive and premium vegan options that are more viable for the public of New Zealand who has had an immense vaccination program and border closure policy.

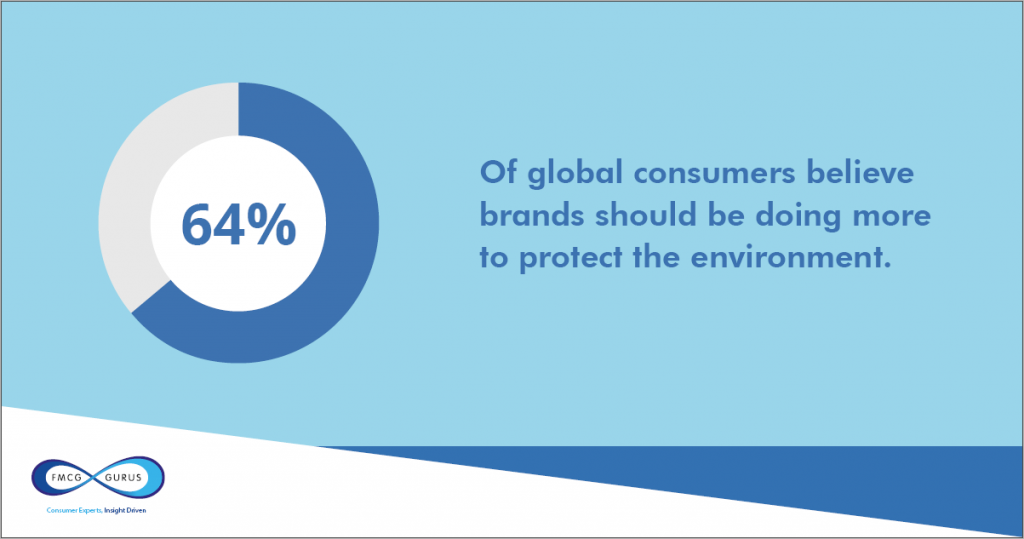

Consumers are receptive to the brand image of societal responsibility with greater awareness of the impact of using societally irresponsible brands. 40% of global consumers say that brands should launch more sustainable products in the wake of COVID-19 (2020). During recessions, consumers become more driven to achieve value for their money and this case remains for value consumers receive by endorsing brands that impart a philosophy that aligns with theirs.

Values that align with consumers that have been undertaken are kindness, compassion, and social responsibility. This links to how consumer mentality is shifting diets to become socially responsible with the increased prevalence of veganism as an example. This is a consideration that is significant enough for vast swathes of consumers to continue to buy environmentally friendly and societally responsible products even if suffering from the economic effects of a recession.

Eating at Home

Due to several factors, ordering food at home has accelerated. Covid-19 has caused a need for consumers to replicate their nights out with their only option of the venue being at home. Covid-19 has caused a rise in demand for delivery services which has caused a notable rise in prices which affirms this point. This means that food service producers are now mostly aware of the necessity of being connected online and this provides moderate protection from potential second and third waves affecting sales. This is a shrewd way of ensuring the same level of sales as baby boomers are replaced by Generation Alpha who have grown up using technology.

16% of global consumers state that they spend over forty hours in the average week in front of PCs and/or laptops (2019) and this figure will continue to rise. A consideration of consumers has emerged to be a growing emphasis on spending time with family, this has likely been onset by fear from Covid-19. This is likely to denote more upscaling of food when shopping for social occasions that can be complements to trends such as consuming TV and media. For consumers who have reduced their big nights out and thus have more disposable income, there has been a knock-on effect in other areas of shopping and food and beverage consumption.

If habits develop of inactivity due to the Covid-19 lockdown, this could be widespread amongst different generations. 31% of consumers say that they have put on weight in the last twelve months (2021). 52% of global consumers admit to being concerned about the amount of time they spend indoors on technological devices (2020). There is concern about the high average inactivity rate amongst Generation Alpha due to increased consumption of technology and media. Although average rates of activity are increasing among Generation Z and above (45% of global consumers say that they do not have enough time to exercise (2019)), there is a health gap opening between those who are inactive and active.

World Health Organization data has shown that the number of infants and young children (classified as those aged 0-5 years) classified as obese has increased from 32 million across the globe in 1990 to 41 million in 2016. With more youngsters obese than ever before and a potential rise in habits of poor health and inactivity, this provides an opening for pharmaceutical producers to provide products that remedy this.

Hi/Low Consumerism

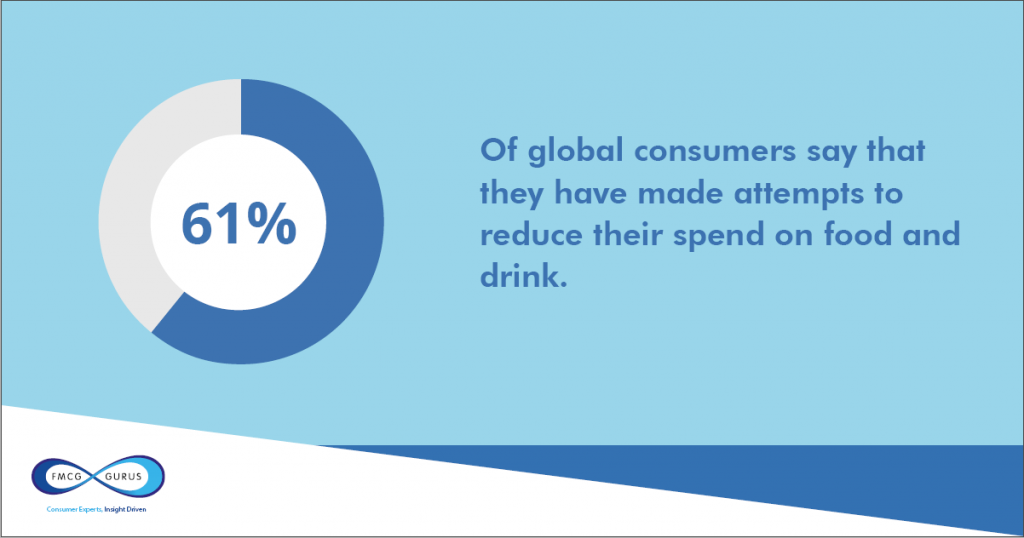

As a result of their economy affecting consumer confidence and lockdown preventing unnecessary spending on food, consumers in high covid countries are reducing spending when shopping. Consumers are looking for ways to make their money go further due to decreased financial stability. However, the savings made through buying inferior products are being reallocated to upscaling elsewhere. This is because consumers are still attentive to the taste and nutrition of certain products and are unwilling to forgo these things.

The main products that should perform best are the most established brands as brand loyalty has become less of consideration by consumers and so small businesses are likely to be affected much worse if they do not acquiesce to consumer attitudes around social impact or health perception to develop a positive brand image.

Shifts in Types of Foods Consumed

During recessions, luxury goods (Veblen goods) typically decrease in sales, however, as previously demonstrated, factors such as the environmental impact and health are areas that are within the premium bracket but are more demand inelastic. Other products that provide comfort or leisure are demand elastic and so retaining consumers will require a change in consumer perception. Luxury products require a premium when being eaten out and so when buying in stores consumers may still be likely to because they can afford it. There is a psychological factor to increase the consumption of luxury goods where more subtle branding could make a pass on the impression that they are not being frivolous when they’re in financial Peril. A worthwhile strategy could also be to market as a replacement for eating out.

Conclusion

Recessions induce frugality from consumers which naturally leads to decreased consumption of luxury goods. Foods and beverages that will, to some extent, be exempt from this are ones that project progressive messages about society and the environment the allow consumers to align themselves with the perceived views of the producer. Connected to these habits of upscaling to environmentally and socially responsible products, hi/low consumerism is going to be the method in which consumers budget. This will alienate producers of luxury goods without strong enough brand appeal to make their products more inelastic.

Different countries, in accordance with the state of their economies, likely as a result of the success of their vaccine program, will have consumers use recessionary habits at increased rates. This should be a consideration of producers when they consider the success of Veblen vs Giffen (necessary) goods. Eating at home will mean ordering food becomes more prevalent and will marginally increase when generation alpha joins the consumer base.

News outlets, such as the BBC and FOX, have speculated how long the recession will last, how long until unemployment falls to normal rates, and these are good starting points to evaluate how long until consumer habits change in accordance with a growing economy again. “The world economy will shrink by 4.4% in total this year, according to International Monetary Fund forecasts,” says the BBC which tells us that the effects will be felt, to some extent, all around the world.

From the 2008 financial crisis in the UK, there were five consecutive quarters of negative economic growth and then unemployment in the UK returned to regular rates two years later. To what extent the covid pandemic will recover like a “V” shaped recession if countries are able to mobilize factors of production quickly enough, whether it will resemble the 2008 two-year unemployment recovery or an elongated recession with entrenched economic problems that only a Roosevelt character can lift an economy from, is yet to be seen and will resemble all of these in different economies across the world.

Written by: Adam J